Caring for your elderly parents includes helping them set up a financial plan for their future retirement. It is important to have open communication about finances with your elderly parents as soon as now.

Setting a sensitive and caring yet respectful tone towards your concern about their future retirement and finances will help develop trust between you and your elderly parents.

Medling with seniors’ finances can take a toll on some relationships as money is a sensitive topic for anyone even family members. Creating a financial plan for elders is even more difficult, as it requires mutual trust between the parent and the child.

Having their children handle their finances can be daunting to some elders as they may feel to be losing control over their lives.

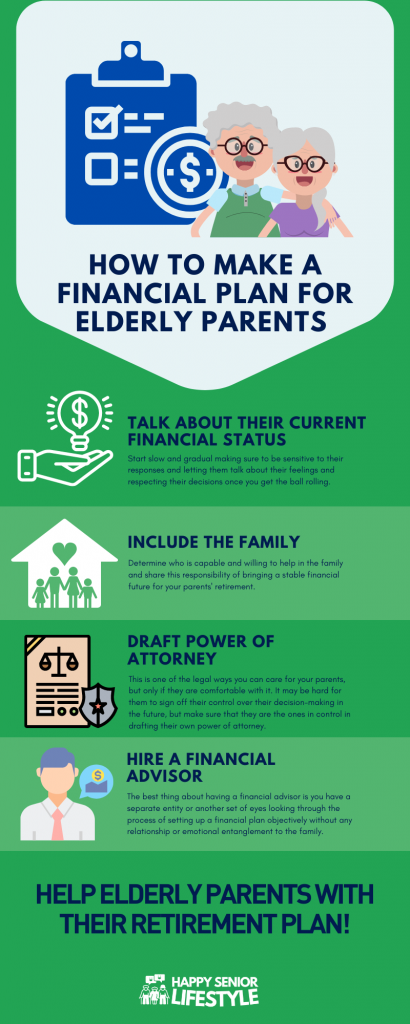

Talk about their current financial status

Elderly parents can be sensitive when talking about money, more specifically about their financial status with their children. But this sensitive topic must be addressed as early as possible in order for both sides to help each other. Start slow and gradual making sure to be sensitive to their responses and letting them talk about their feelings and respecting their decisions once you get the ball rolling.

Once they warm up or start to open up to you then the first thing you want to tackle is their current financial condition. Let them know that it is in your best interest to care for them and take care of their finances as they age.

Asking your elderly parents where they stand financially can be started by making a finance sheet of their assets and even their liabilities.

Compute their sources of income such as their employment, pension, investments, social security fund, and other forms of income.

Help them compute for their living costs as well. Your elderly parents may opt to downsize and move to the countryside for a simple and humble lifestyle or stay in the city. Their living expenses will largely depend on their lifestyle choice when they retire. Determine their monthly needs and even their healthcare needs to know if their income matches that.

If you yourself are clueless about how to handle your parents’ finances, then you can hire a financial advisor to assist you and your parents.

A financial advisor can help predict and organize your parents’ cash flow in the future when they retire. The goal here is to determine if their income will be able to support their living costs when they retire.

It is important to make this organization and predictions to see what changes you can make to make ends meet.

Planning for your own financial security in the future

Before you step in and take care of your parents’ financial stability for their future retirement, you have to make sure that you have secured your own as well. That does not mean that you have completely perfected or secured your own retirement savings because that will take years to accumulate, but at the very least you have an idea on how to work out your own financial future and you are on your way to that goal.

By taking care of yourself first before stepping in to have a talk about your parents’ financial plans in the future, you are eliminating possible conflicts, and you could better help them by being focused on their needs instead of juggling them with yours.

If you find your parents’ current financial status in shambles or not able to provide enough support for their retirement, then you would immediately know up to what part or how much you can help and contribute to it without jeopardizing your own retirement plans and fund. Sharing this burden with other family members such as your siblings could also help this process be easier.

Include the family

As mentioned above, you do not have to carry this burden alone, and you definitely do not need to jeopardize your own financial security to save your parents. Include the family members who are capable of bring something to the table. Determine who is capable and willing to help in the family and share this responsibility of bringing a stable financial future for your parents’ retirement.

Once you have to pinpoint key people who can help you set up your parents’ retirement fund make sure they are committed and how much they are willing to commit.

If nobody is capable enough yet, then the sooner you find out, the sooner you can make necessary changes such as trying to get more work to increase your income or make lifestyle changes in order to afford better, more secure future finances.

Draft power of attorney

Taking care of your parents may need a little more help through legal documents such as a power of attorney.

A power of attorney is a legal document that states who will be in charge of certain decisions such as medical and financial decisions when the elderly are not able to make decisions themselves. The reality is that the day may come where they could no longer make important decisions about their medical condition or their finances.

This is one of the legal ways you can care for your parents, but only if they are comfortable with it. It may be hard for them to sign off their control over their decision-making in the future, but make sure that they are the ones in control in drafting their own power of attorney. They will be the ones defining the circumstances where you can step in and just how much control you have to make decisions when needed be.

Hire a financial advisor

Not everybody is ready to take on this very difficult and daunting task of taking care of the elderly parents’ finances. One moment you are being taken care of by your parents, providing for your every need, and the next moment you are the one needing to take care of them and be responsible for their finances.

Also, not everyone has enough knowledge and experience on how to create financial plans for the elderly. This is where hiring a financial advisor who has the knowledge and experience to help you and your parents set up a retirement fund.

It can be a rollercoaster ride starting up a retirement plan and fund for your elderly parents. It really takes a lot of effort and trust on both sides to accomplish this very important endeavor. Also, emotions are involved in this situation, and not everybody has a good standing relationship with their parents around this season in their lives. The best thing about having a financial advisor is you have a separate entity or another set of eyes looking through the process of setting up a financial plan objectively without any relationship or emotional entanglement to the family. This is very helpful in case of disputes and disagreements as financial advisors can suggest effectively without bias, and with proper knowledge about the matter.

Review existing documents and update them

Keeping track of your elderly parents’ existing legal documents can help you get on the track of their finances and what to expect in the near future. Make sure that all documents are updated and kept in a safe place in case any situation arises.

You may opt to get a vault for these important papers inside your home or get a safety deposit box where you can keep them safe.

As you will be in charge of your parents’ finances when they retire, and you are the one given the power of attorney, you should have direct access to these documents in order to execute their will when needed be.

If your parents have the fortune to be distributed, you should put into consideration rechecking with your elderly parents these documents whenever there are changes in the family such as the birth of their grandchild, death of a family member on the will, or divorce of marriage. Your parents are still the ones to make these important decisions until they are unable to do so.

Conclusion

Taking care of elderly parents is a very noble thing to do especially at this stage in their life where they need support and help from their children. Some parents are unable or not willing to ask for help but as children, we should know when and how to step in their most challenging moments. Helping set up a financial plan for their retirement is a very good step in taking care of your parents well being as they age.