Aging is not something to dread, but something to be prepared for and celebrated as it marks your achievement of gaining much wisdom and experience all throughout your life including your finances!

At this moment in your life, you might have made up your own senior money hacks that will let you get discounts and make the most of your budget, and even get a bit more. Clearly, aging has its advantages and we want to help you learn more about money management for seniors.

If you are not aware yet there are things you can get free as a senior. Surely you would appreciate a steep discount on your necessities or even get things for free that you aren’t aware you could get! Get your notepad and take note of this list because this could save you a few or even a lot more dollars that you could put into your retirement fund instead.

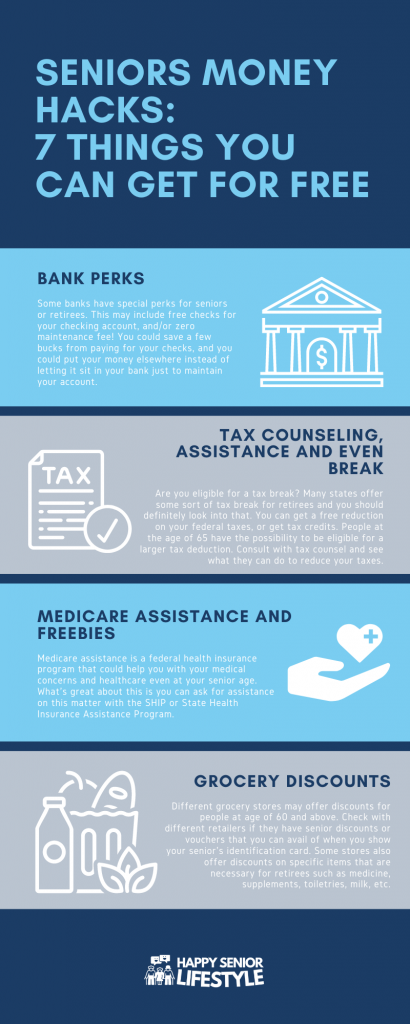

Bank perks

Some banks have special perks for seniors or retirees. This may include free checks for your checking account, and/or zero maintenance fee! You could save a few bucks from paying for your checks, and you could put your money elsewhere instead of letting it sit in your bank just to maintain your account.

Check with your bank and see if there are any perks waiting for you, especially if you have been a loyal customer all these years.

Tax Counseling, Assistance and even Break

Taxes are complex legal matters that some of us can not wrap our heads around, and even more, it is a tiresome responsibility that we can all use help doing. Retirees can relax and get free tax counseling and assistance when filing their taxes with the federal government program that tackles just that. The TCE Program or the Tax Counseling for the elderly program seeks to remove the worry of retirees about accomplishing their tax obligations. Seniors with age 60 years and above are given special assistance on everything related to their pension, taxes, and retirement-related issues.

Are you eligible for a tax break? Many states offer some sort of tax break for retirees and you should definitely look into that. You can get a free reduction on your federal taxes, or get tax credits. People at the age of 65 have the possibility to be eligible for a larger tax deduction. Consult with tax counsel and see what they can do to reduce your taxes.

Medicare assistance and Freebies

Medicare assistance is a federal health insurance program that could help you with your medical concerns and healthcare even at your senior age. What’s great about this is you can ask for assistance on this matter with the SHIP or State Health Insurance Assistance Program. They could provide you counseling for your Medicare benefits, as well as your family. Make the most out of this healthcare program where you will not need to pay a single cent.

Also check your Medicare plan for extra services that are considered as freebies, because you do not need to pay any additional cost to services that are covered in full. These include annual wellness checks, some types of vaccines and shots, and some types of screenings. Check with your Medicare plan and see what hidden freebies are available for you.

Grocery Discounts

Different grocery stores may offer discounts for people at age of 60 and above. Check with different retailers if they have senior discounts or vouchers that you can avail of when you show your senior’s identification card. Some stores also offer discounts on specific items that are necessary for retirees such as medicine, supplements, toiletries, milk, etc.

Other communities also have grocery stores that cater to senior citizens where they could get more assistance such as free deliveries, or complimentary items and discounts.

Learning

Up to learn more? There is no need to stop learning as you can avail yourself discounts to some colleges and universities where you can apply for greatly discounted classes. If you are lucky, there are also practical tuition-free classes that you could pursue.

Depending on your needs or wants, there are also options to attend a credit-free class that has zero tuition, meaning because you will not be getting a degree by the end of the course, you do not need to pay tuition as well. So feel free to keep on pursuing knowledge as there are colleges and universities opening their doors for senior citizens.

Also, there are digital courses that are free regardless of age, which you can avail of for free.

Public transportation

Traveling can become tricky for seniors and retirees, and not everyone wants to keep driving a car. Getting rid of your car to downsize on your expenses is a good way to save some cash. The downside to it is you will have to get around using public transportation which can become quite a challenge. There are some states and local communities that offer transportation assistance for seniors. Check your local community to see if there are any free transportation options for seniors, or if you can avail discounts on certain transportations.

Also, it is a good idea to consider moving to a senior-friendly community where you are just a walk away from your necessities, wherein you do not have to keep needing transportation just for a jug of milk.

Look into communities that encourage walking and biking as opposed to cars. Check the traffic, sidewalks, and even high bridges in the community. You can see if it is easy to walk around, or if there are too many stairs, or cars around that discourages walking. Also, check on the available public transportation in your chosen community to see if it is accessible and affordable.

Conclusion

There are plenty of discounts and freebies available for seniors and retirees if you just look and ask for your needed establishments. Some establishments may not put out those discounts on posters, but it never hurt to ask if it is available.

The list above is just a few of the services and products you could avail yourself of for free. There are plenty more like leisure, entertainment, travel, and more! This could help you save a few more bucks for your retirement fund and make your retirement life more fun and worth it!